What is Comprehensive Auto Coverage?

There are many factors that need to be considered when purchasing auto insurance. While auto insurance is often seen as a way to protect drivers when they get into an accident, vehicles also need protection, as there are many ways they can be damaged without actually being involved in a collision. That’s where comprehensive coverage comes into play.

If you don’t have this type of coverage included in your auto policy, you may want to consider adding it in order to give yourself an extra layer of security. Continue reading to learn more about what this coverage and if you should include it in your policy.

What does it cover?

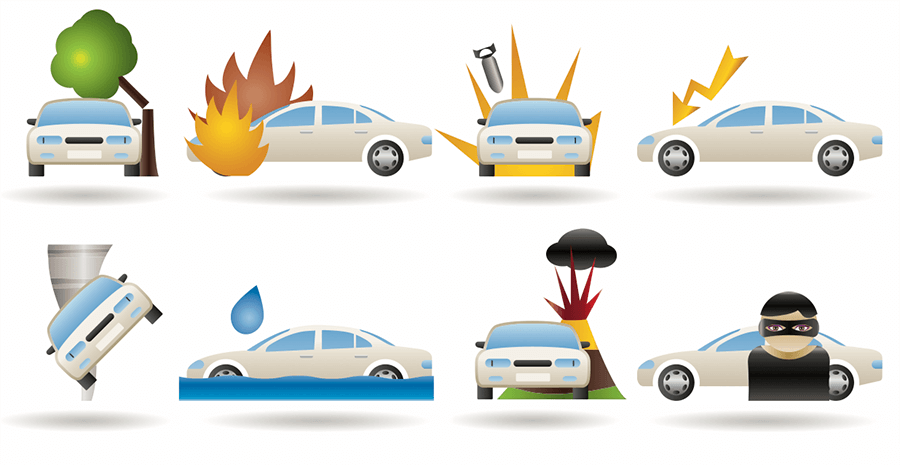

In general, comprehensive coverage refers to coverage that protects your vehicle in the event of damage by incidents other than collisions. Comprehensive coverage kicks in and helps out with potentially expensive repairs or replacement costs resulting from a wide variety of incidents including, but not limited to:

- Vehicle theft

- Falling objects, such as a tree or tree branch

- Fires

- Inclement weather like hail, flooding or lightning

- Explosions

- Striking, or being struck by, an animal

- Natural disasters like earthquakes, tornadoes or hurricanes

- Riots and vandalism

- Damage to the windshield or any glass

What does it not cover?

While it does offer a number of valuable protections, comprehensive coverage does not typically cover costs associated with:

- Collisions

- Towing

- Rentals

- Medical and legal expenses

- Property stolen from your vehicle

Although comprehensive coverage is optional in most states, you may be required to carry this form of insurance if you are leasing or financing your vehicle. Like many other types of insurance, whether or not comprehensive coverage is right for you depends on your specific situation. In many cases, having this extra layer of protection can help protect your pocketbook.

Contact The DeHayes Group today to learn more about comprehensive coverage and how it may be able to keep you and your vehicle safe.